Business

Economy

Education

Finance

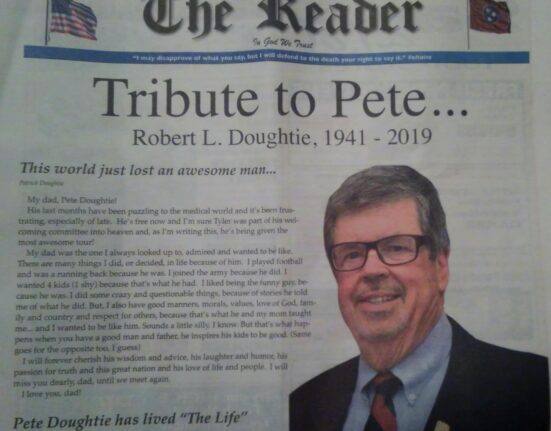

Leaving a Legacy

Life Style

Politics

Schools/Education

Tennessee Business

Got Debt? Did You Know Consumer Debt Has Reached an All-Time High?

- by admin86

- May 1, 2025

- 0 Comments

- 2 minutes read

- 192 Views

- 2 months ago

Leave feedback about this